INTERNATIONAL

For clients residing or having assets outside France, Michelez Notaires provides assistance in the following domains:

Real estate investments

Real estate investments in France

– Financing of investment and obtaining appropriate mortgage guarantees,

– Acquisition structuring, possibly including the constitution of a company,

– Legal auditing of real estate assets purchased or for sale and, where applicable, establishment of a digital data room,

– Drawing up of legal documents for the purchase and sale of property,

– Legal and tax advice to help structure acquisitions under optimal conditions,

– Assistance in establishing supplementary technical audits, compiling financial dossiers, submitting annual tax declarations etc..

Estate Planning

Estate Planning

– Gifting by non-residents holding real estate assets in France,

– Gifting of assets located abroad by or for the benefit of natural persons and legal entities resident in France for tax purposes,

– Anticipated succession,

– Civil and fiscal optimization of asset transfer,

– Designation of applicable law (marital property regime, inheritance),

– Marriage contract,

– Inheritance settlements involving a non-resident or an asset located outside France.

Partnerships

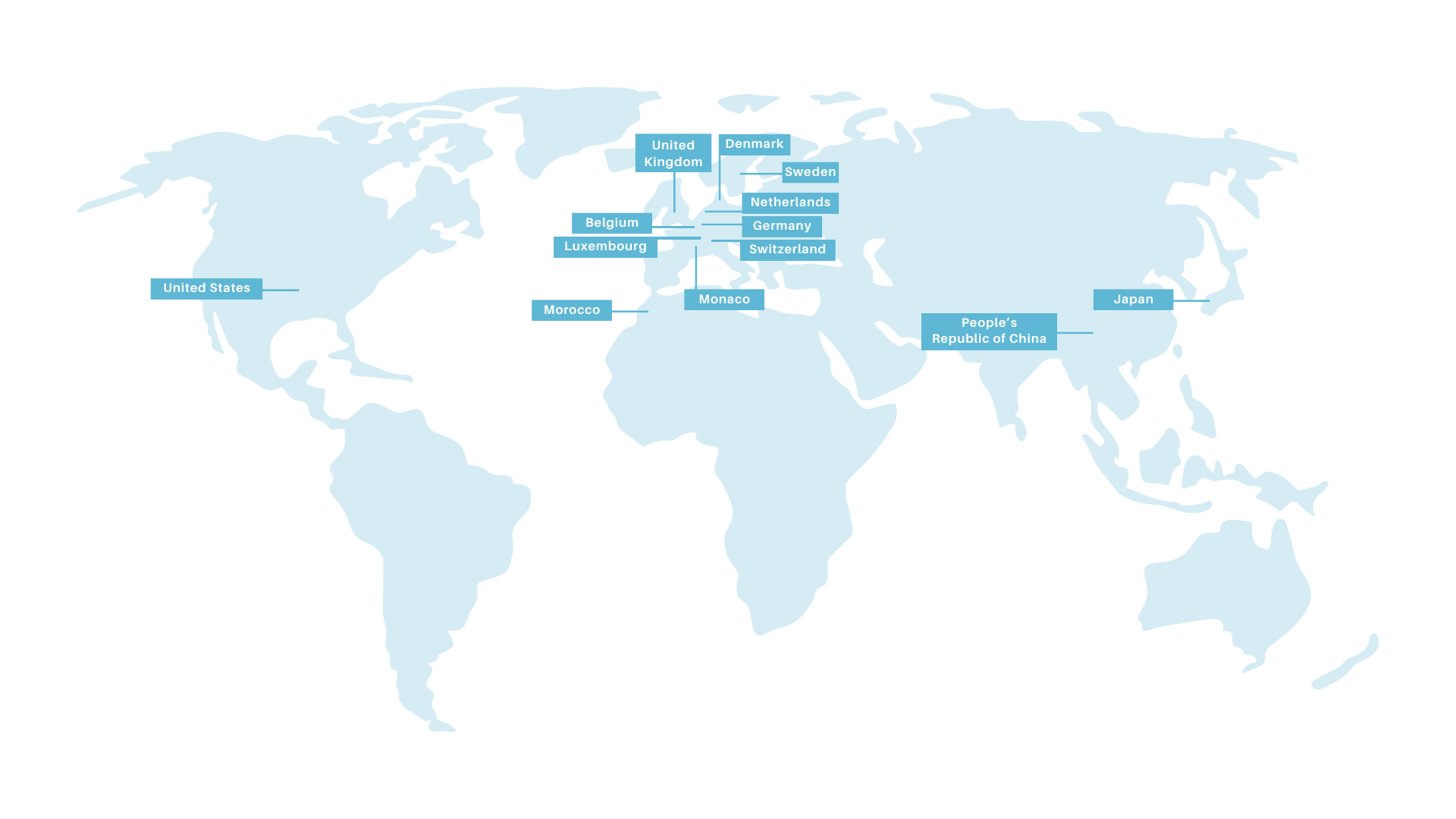

Michelez Notaires has established a partnership with a network of professionals to ensure optimal understanding of the legal and fiscal constraints in the following countries: